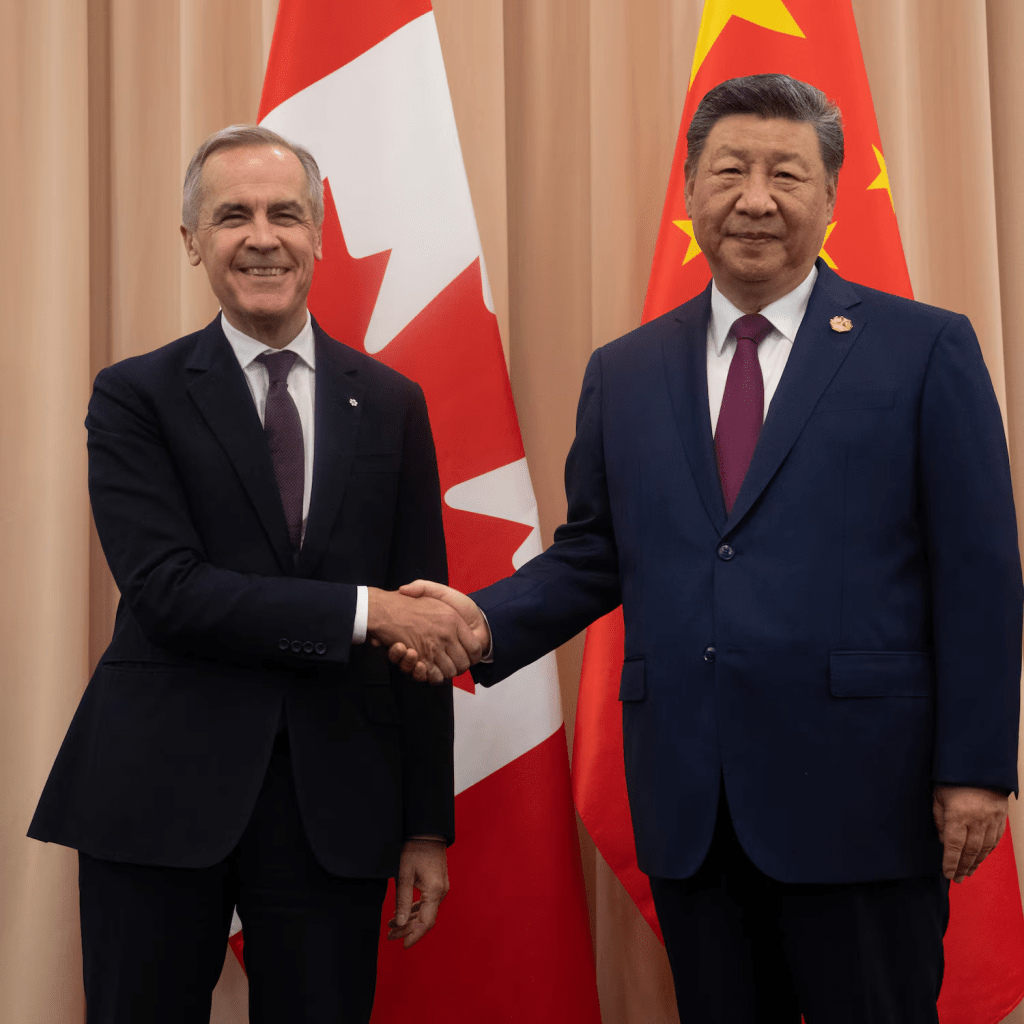

The fragile economic relationship between North America’s largest trading partners reached a breaking point this week. Following Canadian Prime Minister Mark Carney’s announcement of a strategic trade partnership with China, U.S. President Donald Trump issued a scorched-earth ultimatum on Truth Social: “If Canada makes a deal with China, it will immediately be hit with a 100% Tariff against all Canadian goods and products coming into the U.S.A.”

While Trump initially signaled openness to Canadian trade autonomy, the rhetoric soured after Carney’s Davos speech, where he claimed the “US-led world order had been ruptured.” Trump retaliated by rescinding Canada’s invitation to his Board of Peace, asserting, “Canada lives because of the United States.”

1. The Pivot to the East

Despite the threats, Canada’s Minister of International Trade, Dominic LeBlanc, clarified that the government is not seeking a full Free Trade Agreement (FTA) with Beijing but rather a “resolution on critical tariff issues.” Under the new agreement with President Xi Jinping:

- Canola Oil: Chinese levies will drop from 85% to 15% by March.

- Electric Vehicles: Canada will slash tariffs on Chinese EVs from 100% to the most-favoured-nation rate of 6.1%.

Carney framed the deal as essential for a “new world order,” aiming to reduce Canada’s 75% export dependency on a volatile U.S. administration.

2. The Mutually Assured Destruction of Trade

The escalating conflict poses severe structural risks to the U.S. economy, specifically across three critical sectors:

3. The Energy Shock

U.S. Gulf Coast refineries are architecturally locked into Canadian heavy crude. Billions have been invested in cokers and hydrocrackers specifically designed to process thick Canadian bitumen.

- Irreplaceability: With Venezuelan and Mexican heavy crude production in decline, Canada now provides over half of all U.S. crude imports.

- The Fallout: A 100% tariff would effectively starve U.S. refineries or force a catastrophic spike in gasoline and diesel prices for American consumers.

4. Food Inflation: The 2026 Potash Crisis

American farmers face a Potash Crisis that could double fertilizer costs by Spring 2026.

- Supply Chain Vulnerability: Despite some tariffs being lifted in late 2025, the Trade Commissioner Service warns that renewed 100% duties on Canadian potash—a primary source for U.S. agriculture—would jeopardise the 2026 planting season and trigger historic food price volatility.

5. Defense Sector: The Golden Dome at Risk

The U.S. defense sector is currently scrambling to secure aluminum and cobalt for the Golden Dome—a next-generation integrated air and missile defense system.

- Strategic Shift: The U.S. has been using Defense Production Act (DPA) funds to finance Canadian mining projects in Quebec and the Northwest Territories.

- The Irony: Trump’s proposed tariffs would tax the very minerals the Pentagon deems “essential for national security” to counter China, effectively subsidizing the cost of U.S. defense through American taxpayers.

6. The Automotive Breaking Point

The integrated just-in-time supply chain of the Great Lakes region faces collapse. With tariffs on parts—including engines and transmissions—potentially reaching 100%, the Canadian Vehicle Manufacturers’ Association warns of:

- Price Surges: Thousands of dollars added to the price of every North American-made vehicle.

- Manufacturing Exodus: Production slowdowns and massive layoffs as automakers struggle to restructure supply chains that cross the border up to seven times during a single build.

7. The Water Bomb

Trade disputes have significantly strained the 1909 Boundary Waters Treaty and the Great Lakes Water Quality Agreement. While these remain distinct from commercial pacts like CUSMA, current tensions are destabilizing their implementation:

- Diplomatic Disruptions: In March 2025, the U.S. administration abruptly excluded Canadian mayors from a longstanding White House meeting during the annual Great Lakes Day summit, citing “diplomatic protocols”. This unprecedented break from tradition raised fears that shared environmental resources are becoming “collateral damage” in trade rifts.

- Water as a Trade Lever: Growing concern exists that the U.S. may leverage shared water management in future trade talks, potentially revisiting demands for bulk water diversions to drought-stricken American regions.

- Regulatory Conflict: Friction is mounting within joint management frameworks as American shippers argue that stricter Canadian environmental standards create a competitive disadvantage.

- Risk of Treaty Termination: Although it has endured for over a century, the Boundary Waters Treaty can be terminated with 12 months’ written notice. Escalating trade wars could lead either nation to withdraw legally, ending mandates for joint consultation on pollution and diversions.

8. Criticality of Critical Minerals

As of early 2026, tariffs have severely disrupted industries reliant on minerals essential for defence, manufacturing, and energy.

- Integrated Supply Chains: The U.S. remains heavily dependent on Canada for gallium, niobium, aluminum, palladium, and platinum—minerals deemed crucial for electronics and military technology. Canada serves as a vital storehouse, meeting approximately 25% of U.S. uranium demand and providing essential feedstock for nuclear energy and defense.

- China’s Strategic Advantage: Tensions between the U.S. and Canada have allowed China to position itself as a more stable alternative. For instance, a 25% tariff on Canadian nickel may force U.S. manufacturers toward cheaper Indonesian nickel, which is largely controlled by Chinese mining companies. This undermines Western efforts to secure strategic autonomy.

- National Defence Vulnerability: Mineral supply chains support advanced systems like precision-guided munitions, F-35 fighter jets, and secure communication networks. Trade disputes that escalate production costs or delay manufacturing directly impact military readiness and the strategic autonomy of both nations.

9. Conclusion

Trump is facing limited domestic pressure to resolve the U.S.-Canada trade standoff and appears politically positioned to wait Canada out. His administration has prioritized other trade deals and framed Canada as a low-priority partner.

There is little pressure from US businesses. While some US industries (e.g., auto, agriculture, tourism) are affected, there’s no unified business lobby pressuring Trump to resolve the dispute. His 51st state rhetoric and claims that Canada cheated resonate with populist messaging.